The Amazon flywheel: part 2

As a nine year old I used my parents’ dial-up connection to make my first e-commerce purchase: the Mulan soundtrack, via Amazon.com. It took three weeks to get from Amazon’s Seattle warehouse to our address in Bellevue, WA. I know because I agonized over the days, and how each one, in succession, delayed my reenactment.

Today’s youth can expect a similar purchase from Amazon to arrive within two days.

All of this is to say, the Amazon supply chain wasn’t always the swift, efficient, ever-expanding machine that it is today.

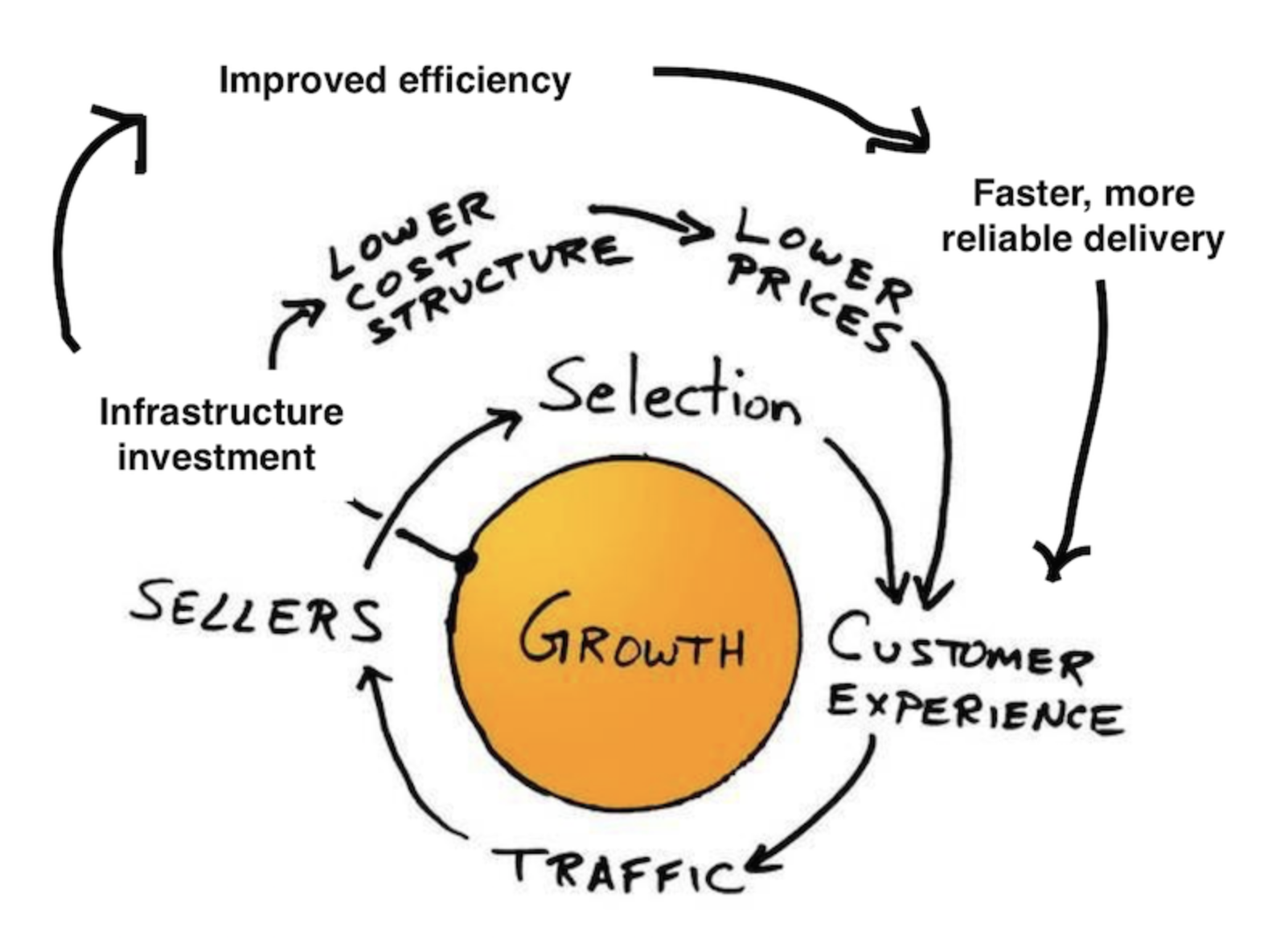

In last week’s post I covered Amazon’s flywheel and how, through engines of new growth and scale, the company reinvests earnings back into infrastructure. One of these infrastructure investments was Fulfillment by Amazon (FBA), Amazon’s inventory and logistics overhaul.

In this week’s post, I’ll review how Amazon regained control over its supply chain through the FBA initiative and how, moving forward, the company will continue to expand both downstream -- through continued investment in same-day, urban delivery -- and upstream -- through an expansion in cross-border infrastructure.

As a quick refresher, here’s my version of the Amazon flywheel, which breaks out improved efficiency (and the faster delivery times that result from it) as a part of the wheel and a key differentiator for Amazon’s customer experience.

Amazon Supply Chain Beginnings

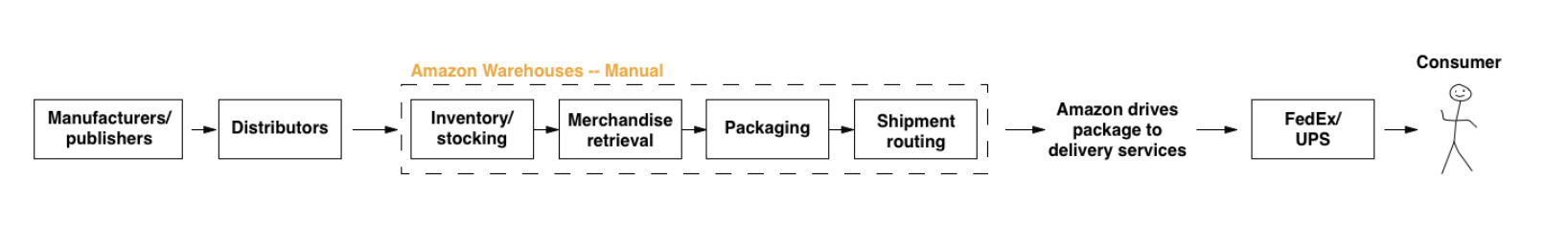

In the beginning Amazon sold books. They bought them from distributors, stored them in their warehouses, and sent them off to traditional logistics providers when they received a customer order.

If we lay this out (and abstract for simplicity’s sake,) we get the diagram below. This entire process was manual.

Growth and Amazon’s Logistics Overhaul

In 2000, Amazon launched Marketplace, bringing 3rd-party sellers into an Amazon supply chain that had grown to include more than just books. The added volume from 3rd-party sellers and additional product categories outstripped the manual processes within their warehouses. Customer orders were often late or unfulfilled (e.g. my Mulan soundtrack.)

Amazon handled this in two ways.

First, automation.

Bezos and his executive team realized that if they couldn’t improve on delivery, they’d be at a serious disadvantage to in-store retailers. In 1998, if I’d gone to Tower Records instead, I would have had my Mulan record that day. Instead, I waited three weeks. The burden of the early adopter.

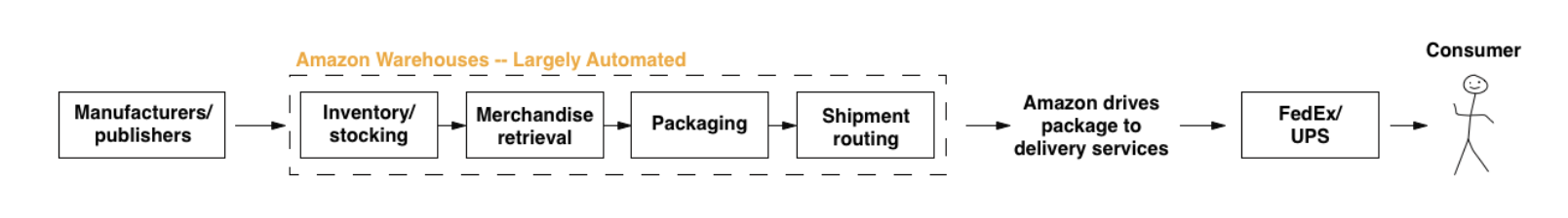

Amazon poured investment into revamping these warehouses, automating merchandise retrieval and routing. The output of this investment was the massive Fulfillment Center network.

Second, logistics-as-a-service.

Once Amazon built its Fulfillment Center network to a point where it could handle additional capacity, they started offering it as a service to third-party sellers.

All of this fed the flywheel, enabling Amazon to reinvest third-party service income back into their logistics infrastructure, furthering their goals of improved cost structure and delivery time.

If we look back on Amazon’s early day supply chain and evaluate how it changed through the FBA years, we land here:

The distributors were bypassed through Amazon’s direct negotiations with publishers/manufacturers/sellers, and Amazon manual warehouses evolved into largely automated Fulfillment Centers. (That link jumps to a video tour of an Amazon Fulfillment Center. It’s worth your time. The conveyor belt speed at 2:22 is intimidating.)

With all of this we see Amazon gaining cost structure control over its own supply chain components (the warehouses) as well as those components that lived upstream -- i.e. the distributors.

Amazon: Downstream

This takes us into Amazon’s downstream supply chain expansion.

If we look at this through the lens of the flywheel, we know Amazon will expand downstream as long it enables them to a) gain more control over their cost structure and/or b) reduce delivery time for customers.

This strategy started as early in 2014 with the Amazon Prime Now and Last Mile initiatives, projects aimed at building a downstream logistics infrastructure for shipping direct from Fulfillment Centers to customers.

“As a prelude to the U.S. moves, Amazon has been testing a delivery network in the U.K. "We've created our own fast, last-mile delivery networks in the U.K., where commercial carriers couldn't support our peak volumes. There is more invention to come."” -- Bezos in his annual letter to shareholders, 2014

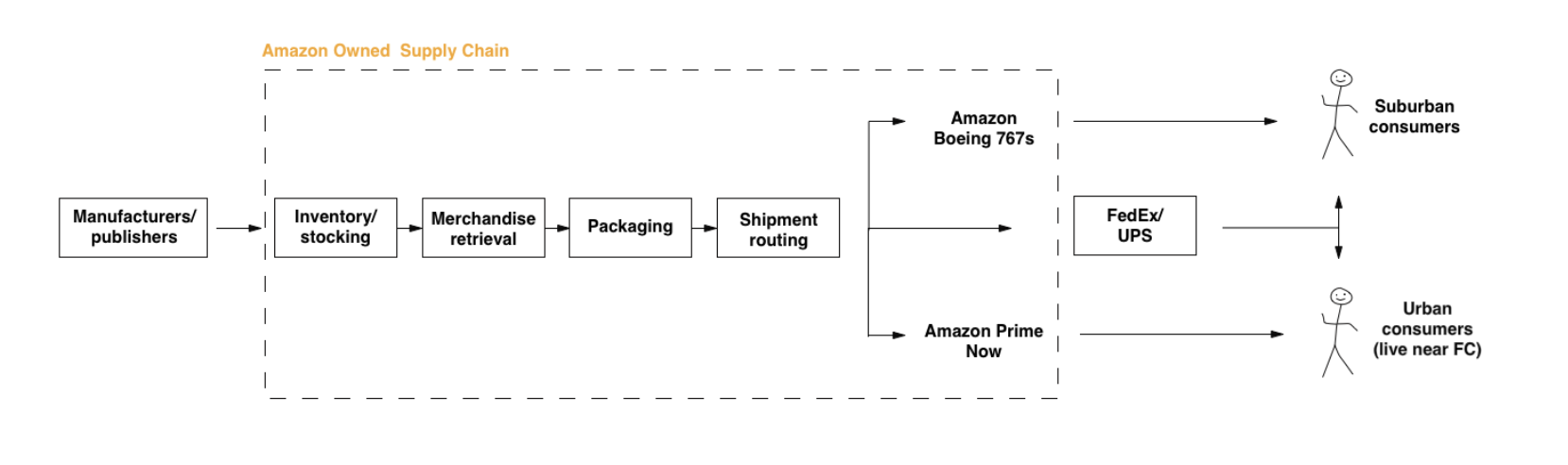

As it stands today, Amazon can only pursue this same-day, direct-to-consumers strategy for those customers within reasonable distance of an Amazon Fulfillment Center. Any farther and Amazon depends on its full-service logistics providers -- UPS, FedEx, USPS -- to fly them to customers.

Amazon had started addressing this Fulfillment-Center-range issue in 2014 through the development of sortation centers: smaller extensions of the Fulfillment Centers that get packages closer to customers.

Now, Amazon is replacing their logistics providers altogether.

Last week brought the official news (everything prior was hearsay) that Amazon would be leasing twenty Boeing 767 freighters from Atlas Air, signaling Amazon’s entry into a space that they’ve historically left to the traditional logistics companies. The response from Amazon management was one of deferral, along the lines of “we’re just doing this to have greater supply chain capacity during the holidays, not to eat anyone else’s lunch.”

I think they’re pursuing a larger opportunity. Here’s an excerpt from an Amazon job listing that does a good job of outlining the company's goals in downstream logistics:

"Amazon is growing at a faster speed than UPS and FedEx, who are responsible for shipping the majority of our packages. At this rate Amazon cannot continue to rely solely on the solutions provided through traditional logistics providers. To do so will limit our growth, increase costs and impede innovation in delivery capabilities." -- Amazon job listing, as cited here.

The twenty freighters Amazon leases will constitute a tiny portion of their shipping volume, but the long-term trends are in Amazon’s favor. They’ll use these first planes to learn the ins-and-outs of air freight, with the long-view goal of adding it as an owned and differentiated link within their end-to-end supply chain.

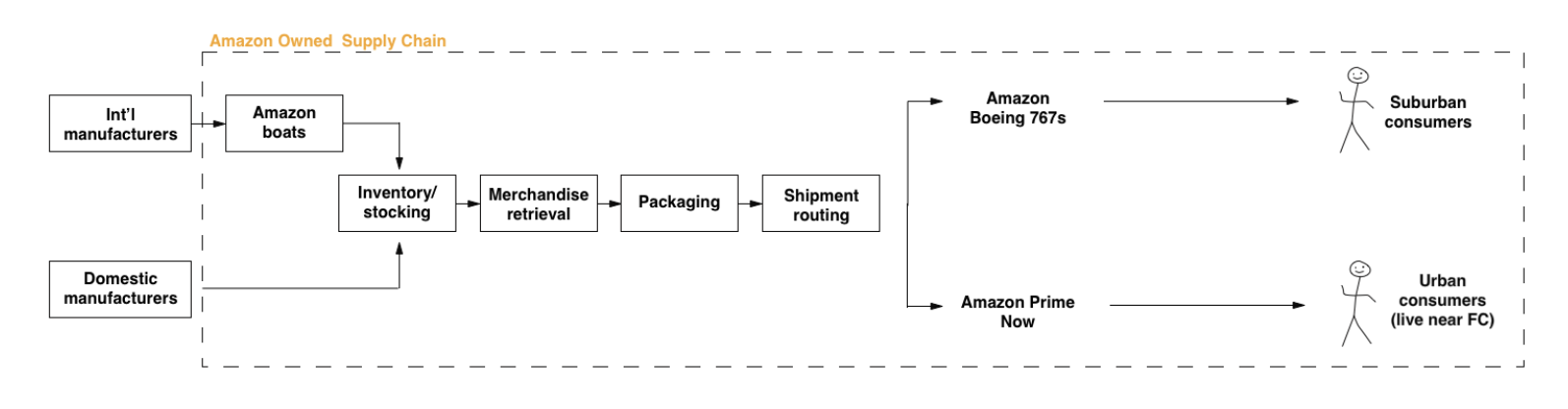

Taking the air freight and same-day delivery initiatives into account, the Amazon supply chain starts to look something like the diagram below, wherein the role of shipping companies gets smaller and smaller over the long-term.

Amazon: Upstream

What might we expect from Amazon in regards to their upstream supply chain?

Global logistics analytics startup Flexport largely answered the question at the start of the year when they broke the news that Amazon had registered to provide ocean freight services. It’s a great read and one that I’ll defer to for explaining why this is such a big move for Amazon.

“Ocean freight is cheap right now. As of January 2016, Flexport’s ocean freight customers were paying less than $1300 to ship a 40-foot container from Shenzhen to Los Angeles. More than 10,000 parcels can fit in a single container, so the price for the ocean freight leg could be as low as $0.14 per parcel. Here’s another way to think about that figure: Right now it costs under $10 to ship a flat screen television across the Pacific.

With ocean freight itself so low, a considerable portion of logistics costs come through labor costs—particularly compliance and coordination of cargo handoffs between different players in the chain. It’s here that automation, something no traditional freight forwarding company can do even one percent as well as Amazon can, becomes the key competitive advantage over legacy freight forwarders. By using software to eliminate additional transaction costs associated with government filings, status updates, pricing, booking and more, Amazon will be able to cut their costs significantly. At the same time, fulfilling products directly from China to consumers in the U.S. will cut handling costs at U.S. warehouses.”

To bring that quote back into the context of this blog post, Amazon will extend their reach upstream and into the realm of international manufacturers. It’s a move that would bring Amazon’s ruthless efficiency into an ocean freight industry that’s largely remained an outsider in the world of automation.

Once Amazon starts ocean freight services, it will be moving product from foreign manufacturers directly to its automated fulfillment centers in the U.S., which, at that point in time, will likely have direct routes to Amazon customers through either domestic air freight or urban same-day delivery.

With all of this in mind, the future of the Amazon supply chain:

With this end-to-end visibility and control of their supply chain, Amazon will be able to further throttle efficiencies out of their process, reduce their cost structure, and give lower prices back to the consumer.

Amazon and Global Trade

All of this adds up to a big long-term vision: Global Fulfillment by Amazon, a one-stop shop for international manufacturers to insert themselves directly into a U.S. logistics network. There’s a loose parallel here to the Stripe Atlas model, in which a U.S.-based company provides international businesses with access to U.S. consumers, enabling those businesses to focus on their core competencies (and not on the paperwork associated with entering the U.S. marketplace.)

This cross-border ease of doing business (if Amazon can pull it off) will be a huge advantage for e-commerce over traditional retail. When cross-border trade is involved, it’s much easier for a company to sell to its international customers online than it is for them to establish a storefront presence in their customers's country of origin. This means more retail market share for Amazon.

Amazon won’t be the only e-commerce company looking to go global. They’ll be competing with Alibaba (et al), who, having conquered Chinese e-commerce, will look to expand to the U.S. market. But Amazon has the better hand here. They cater better to regulators -- if Alibaba wants to operate in the U.S. at scale, they’re going to need to clean up the counterfeit issue -- and, of course, Amazon has their massive FBA network.

There are larger global macro drivers in effect. The U.S. is raising the ceiling on the amount of foreign goods U.S. citizens can import without paying duties. All signs point to global trade and an automated global logistics network to support it. Few companies are in as good of a position as Amazon to win this huge opportunity.